Breaking down the economics behind exploration, development, and production

In upstream oil and gas ventures, understanding the full lifecycle cost of a project is not just a financial necessity—it’s a strategic advantage. From exploration to decommissioning, each stage carries its risks, capital requirements, and long-term financial implications.

For companies aiming to remain competitive, profitable, and compliant in a volatile energy market, mastering project lifecycle costing is non-negotiable.

Now, let us break down what lifecycle costs are, why they matter, and how energy professionals can approach cost management strategically across every phase of an upstream asset’s life.

What Are Project Lifecycle Costs?

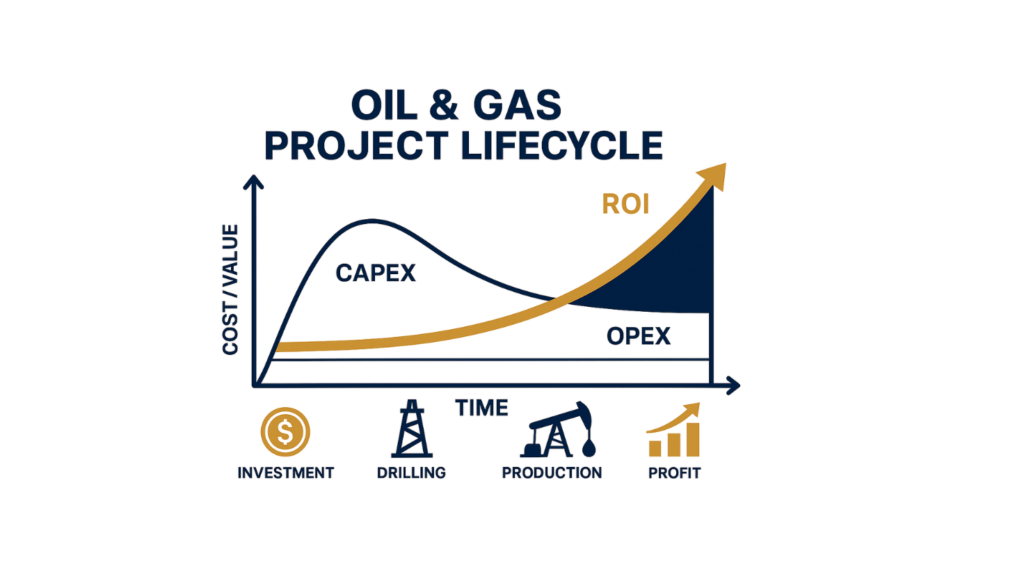

Project lifecycle costs are the total expenditure incurred throughout the life of an upstream asset, from the initial geological surveys to the final abandonment phase. These costs are typically broken into five key stages:

- Exploration and Appraisal

- Field Development Planning

- Construction and Drilling

- Production and Operations

- Decommissioning and Site Restoration

Each stage demands careful planning, budgeting, and financial forecasting. Overlooking long-term costs, especially abandonment liabilities, can significantly distort return on investment (ROI) projections.

Key Cost Components in Upstream Projects

Let’s explore the main cost categories within an upstream venture’s lifecycle:

1. Exploration & Appraisal Costs

- Seismic data acquisition

- Geological and geophysical surveys

- Exploratory drilling

- Environmental baseline studies

These are high-risk investments with uncertain returns, and only a fraction of discoveries become viable fields.

2. Field Development & Engineering

- Concept selection and front-end engineering design (FEED)

- Reservoir modeling

- Infrastructure planning (e.g., pipelines, FPSOs, platforms)

This phase involves major capital expenditure (CAPEX) and sets the foundation for operational efficiency.

3. Drilling & Completion Costs

- Well-designed and engineered

- Rig mobilisation and materials

- Well logging and completion services

One of the most capital-intensive phases, especially in offshore or deepwater environments.

4. Production & Operating Costs (OPEX)

- Facility operation and maintenance

- Staff wages, logistics, and support services

- Energy consumption and chemical usage

- Transportation of hydrocarbons

Over time, OPEX becomes the main cost driver and must be tightly managed to maintain positive cash flows.

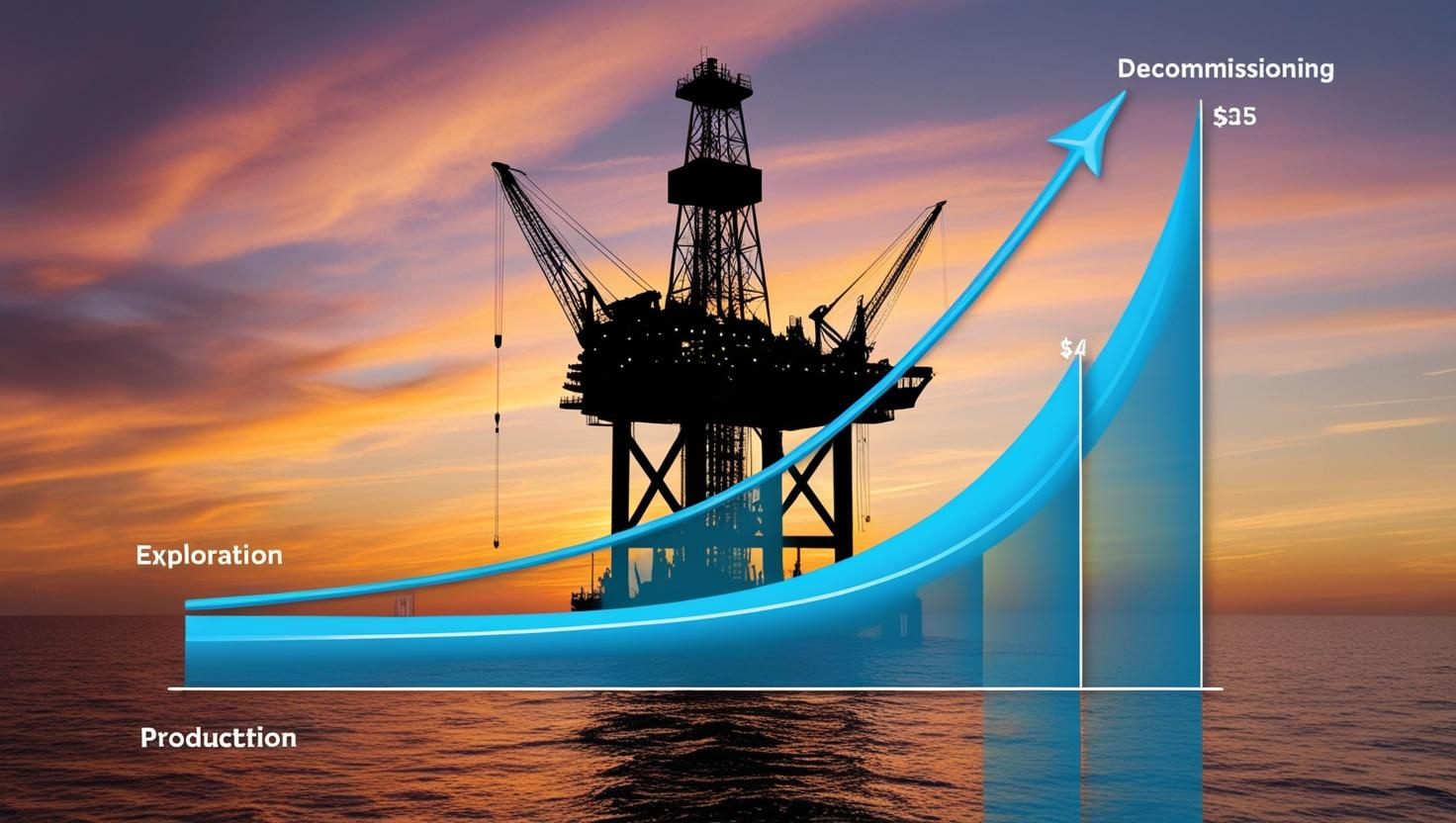

5. Decommissioning & Abandonment

- Plugging wells

- Dismantling facilities

- Environmental restoration

These costs often occur decades after production begins but must be accounted for early in the project’s financial model.

Why Lifecycle Costing Matters

Lifecycle cost understanding helps energy companies:

- Evaluate project viability with accuracy

- Model net present value (NPV) and internal rate of return (IRR) effectively

- Avoid hidden liabilities or underestimated abandonment costs

- Control cost overruns and extend asset life profitably

- Satisfy financial reporting and reserve classification standards

In today’s climate-conscious and capital-disciplined environment, investors and regulators are paying closer attention to full-cycle economics, not just headline profits.

Best Practices in Managing Lifecycle Costs

- Integrated Planning: Cross-functional teams should align engineering, finance, and operations early in the planning phase.

- Scenario Analysis: Use sensitivity modelling for oil prices, production decline, and operating cost fluctuations.

- Digital Tools & Data Analytics: Software like ARIES, PEEP, and Power BI can improve cost estimation, forecasting, and real-time tracking.

- Early Abandonment Planning: Budget and provision for decommissioning from the start, don’t treat it as a future problem.

- Continuous Optimization: Use operational data to refine cost assumptions and benchmark performance year-on-year.

Conclusion

Understanding project lifecycle costs in upstream ventures is crucial for making informed investment decisions, reducing risk, and enhancing long-term project value. As the oil and gas industry faces increasing scrutiny over profitability and sustainability, companies that plan holistically and act proactively will be better positioned for resilient, efficient growth.

At IAA Energy Resources, we help upstream professionals and project teams build clarity into every cost component, from exploration to abandonment. Our training, advisory, and modelling support ensure your decisions are backed by realistic financial insight, not guesswork.

Ready to build a cost-smart strategy for your next upstream project?

Reach out to us at info@iaaenergyresources.com to learn more about our workshops and customized training programs.

0 responses on "Lifecycle Costs in Upstream Ventures"