When an oil field passes its prime, the natural instinct is to move on to greener acreage. But what if, instead of giving up on aging or marginal assets, we reimagine them as untapped opportunities waiting for smarter strategies?

This is the story of field redevelopment, a strategy born out of necessity that is increasingly making economic sense. For many African producers, including Nigeria, Ghana, and Angola, redeveloping brownfields isn’t just about squeezing the last drop; it’s about leveraging existing assets to create a new era of productivity if done right.

The Redevelopment Opportunity

The economics of exploration have changed. Global capital is becoming more risk-sensitive. ESG pressures are tightening the screws on frontier drilling. In this environment, brownfields present a compelling alternative.

Why?

- The subsurface is already understood, at least partially.

- Infrastructure, though aging, exists and can be upgraded.

- Licensing and community relations are often already in place.

- Governments are offering better fiscal terms to encourage redevelopment.

Consider Nigeria’s marginal field program. Many of these assets were once sidelined by major operators due to size or complexity. Now, in the hands of nimble independents and backed by more targeted capital, these fields are finding new life.

But tapping into their potential requires more than optimism. It requires balance, especially between risk and return.

Understanding the Risks

Redevelopment isn’t risk-free. In fact, it introduces a unique blend of technical and commercial uncertainty:

Subsurface Ambiguity: Reservoirs evolve over time. Water cuts increase. Pressure drops. The models built two decades ago may no longer reflect today’s reality.

Aging Infrastructure: Pipelines, flow stations, and storage tanks may be corroded, non-compliant, or even undocumented.

Capital Efficiency Risk: Brownfield CAPEX isn’t always cheaper. Unexpected facility refurbishments, rising service costs, and re-entry failures can quickly erode margins.

Regulatory and Legal Risks: Transfer of operatorship, licensing, and legacy debts often come with tangled paperwork.

That said, with the right data, partnerships, and phased development plans, these risks cannot only be managed but also turned into competitive advantages.

Engineering the Upside: Smarter Strategies for Success

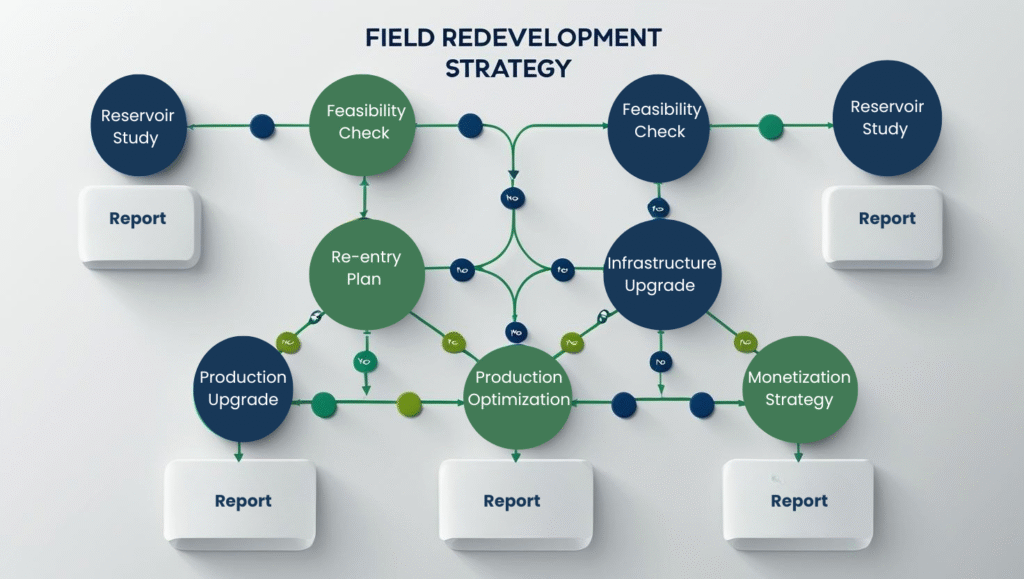

The key to balancing risk and return in redevelopment lies in phased investment and adaptive planning.

Here’s what works:

- Data first, money second.

Before mobilizing rigs or ordering new separators, invest in updated seismic, reservoir modeling, and wellbore diagnostics. Technologies like 4D seismic or fiber-optic sensing are no longer luxuries; they’re insurance. - Use real options thinking.

Instead of committing to a full-field redevelopment upfront, structure it in phases:

- Phase 1: Appraise and test existing wells.

- Phase 2: Recomplete or sidetrack successful wells.

- Phase 3: Expand surface facilities only where needed.

- Phase 1: Appraise and test existing wells.

- Each phase becomes a decision point and an opportunity to pull back or scale up depending on results.

- Leverage modular and mobile infrastructure.

Avoid overcapitalizing on fixed assets. Skid-mounted production units, mobile testing packages, and lease-to-own models can minimize upfront spend and reduce sunk cost exposure. - Partner wisely.

Technical service alliances, joint ventures, and co-development models allow small independents to spread risk while retaining upside. One field, multiple brains. - Plan for decline from day one.

Unlike greenfields, brownfield curves decline faster. Your economic model must reflect this reality using risk-weighted NPVs, decline-curve analysis, and conservative pricing scenarios.

Case Study: OML 30 Redevelopment, Nigeria

OML 30 is one of Nigeria’s largest onshore assets, formerly operated by Shell. After being acquired by Shoreline Natural Resources, a Nigerian independent, the field underwent major redevelopment:

- Re-entry into legacy wells.

- Upgrades to flow stations and pipeline infrastructure.

- Production surged from 15,000 bopd to over 70,000 bopd within 3 years.

- Strategic partnerships and debt financing helped manage redevelopment costs.

This case is a clear example of how brownfield assets can outperform expectations when managed by focused, technically equipped teams.

Investor Takeaways

For energy investors looking at African upstream, redeveloped fields offer shorter time-to-cash, lower exploration risk, and high IRR potential if executed with discipline.

But due diligence must go beyond balance sheets. Key questions to ask:

- Is there an updated reservoir model?

- How recent are the integrity assessments for existing facilities?

- What’s the re-entry success rate for similar fields in the region?

- Is there a competent operations team with brownfield experience?

Investors should also examine the regulatory tailwinds. Countries like Nigeria and Angola are revising marginal field terms and pushing for greater domestic output. These shifts can turn average fields into attractive investments when paired with a credible execution plan.

Finally

Field redevelopment is no longer a second-tier strategy. It’s an intelligent response to today’s energy realities: declining discovery rates, fiscal tightening, and investor scrutiny.

Balancing risk and return in this space doesn’t mean avoiding uncertainty. It means embracing it with better data, tighter execution, and smarter capital allocation.

Need help de-risking your next redevelopment campaign?

At IAA Energy Resources, we specialize in economic modeling, risk analysis, and investment strategies for marginal and mature fields across Africa.

0 responses on "Balancing Risk and Return in Field Redevelopment: A Pragmatic Path Forward"