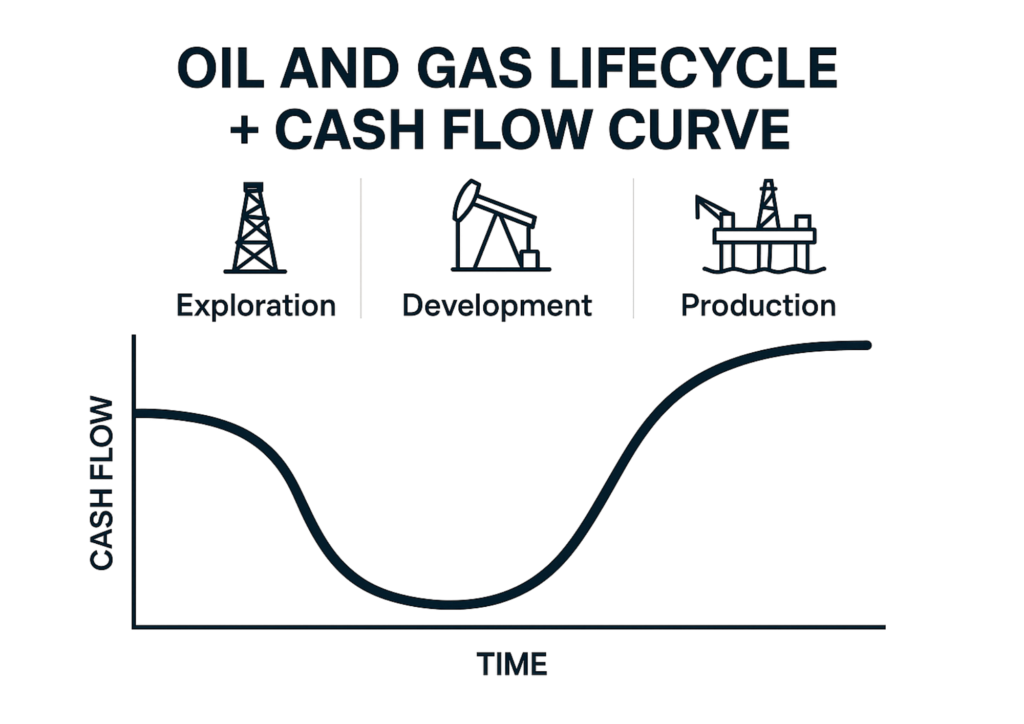

Cash flow modelling is one of the most important tools for making sound financial decisions in the oil and gas industry. From evaluating exploration projects to managing operational expenditures and forecasting future returns, a well-built cash flow model offers clarity in an industry often marked by complexity, volatility, and long timelines.

Understanding the fundamentals of cash flow modelling in oil and gas isn’t just for finance teams; it’s essential for engineers, project managers, decision-makers, and investors alike. It bridges the gap between technical feasibility and economic viability, helping stakeholders assess whether a project is worth pursuing and how to structure it for long-term success.

Let us break down the core components of oil and gas cash flow modelling, explore why it’s critical at every project stage, and highlight best practices for building accurate and actionable financial models.

What Is Cash Flow Modelling?

Cash flow modelling is the process of forecasting the inflow and outflow of cash over a project’s life cycle. In oil and gas, this involves projecting revenues from production, estimating operational and capital expenditures, taxes, royalties, and then calculating the net cash position.

What is the Goal of this Process?

The goal is to assess project viability, maximise value, and inform decision-making for investors and stakeholders.

Why does it matter in Oil and Gas?

- Capital Intensity

Upstream oil and gas projects are notoriously capital-intensive, often requiring billions in investment before first oil. A robust model helps mitigate risk and ensure investors see clear, predictable returns. - Long Project Timelines

Oilfield developments can span decades. Cash flow models capture these long timelines, helping companies assess break-even points, internal rate of return (IRR), and net present value (NPV). - Complex Tax & Royalty Regimes

Governments across jurisdictions have different fiscal systems. A strong model accurately reflects tax structures, royalties, cost recovery mechanisms, and production sharing contracts.

4. Volatility of Commodity Prices

Cash flow modelling allows for scenario planning based on different oil and gas price forecasts. This stress tests projects under various market conditions.

Core Components of an Oil & Gas Cash Flow Model

- Production Forecasts

These are typically derived from reservoir engineering data and influence revenue directly. - Price Assumptions

Based on forward curves, internal estimates, or third-party data providers. This affects the revenue line significantly. - Operating Expenditures (OPEX)

These are recurring costs tied to the operation of wells, pipelines, and processing facilities. - Capital Expenditures (CAPEX)

Initial drilling, development, and facility construction costs. Often front-loaded in the project timeline. - Fiscal Terms

Royalties, taxes, depreciation schedules, and cost recovery terms must be modelled accurately.

6. Economic Metrics

Metrics like NPV, IRR, payback period, and sensitivity analysis guide go/no-go decisions.

Best Practices for Effective Cash Flow Modelling

- Use Realistic Assumptions

Overly optimistic inputs can derail a project later. Use conservative and well-researched forecasts. - Model Different Scenarios

Create base, low, and high-price cases to assess project robustness under market volatility. - Understand the Fiscal System

A small error in royalty or tax calculations can drastically skew results. - Link with Technical Teams

Financial models must be closely tied to field development plans and production profiles. - Automate Where Possible

Tools like Excel, Power BI, and petroleum economics software like PEEP or Merak Peep streamline accuracy and save time.

The IAA Advantage

At IAA Energy Resources, we’ve trained professionals and partnered with organisations across the upstream value chain to build and refine their economic models. Whether you’re an engineer transitioning into a business planning role or a financial analyst working in the field of economics, mastering cash flow modelling will set you apart.

In Summary

Cash flow modelling is not just a financial exercise, it’s a strategic tool that aligns technical planning with commercial realities. In a world where billions ride on a single investment decision, getting it right is everything.

If your organisation is looking to upskill your team or refine your internal modelling approach, we’re just a message away.

Email us at info@iaaenergyresources.com to discuss a training model that suits you or your team.

0 responses on "Fundamentals of Cash Flow Modelling in Oil & Gas"