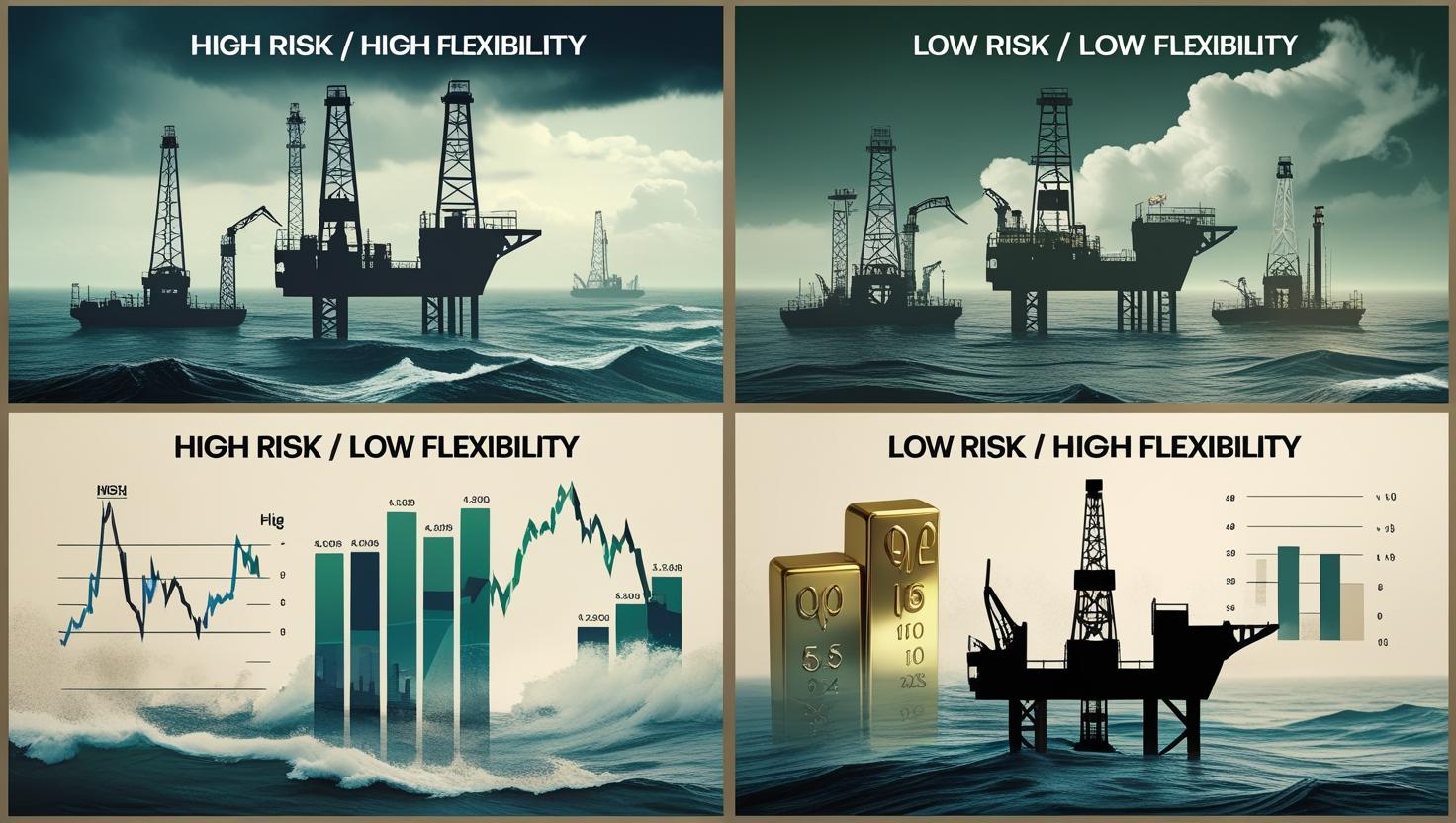

Petroleum investments are rarely straightforward. Exploration outcomes are uncertain, market conditions shift rapidly, and capital commitments span decades. Relying solely on static financial tools like Net Present Value (NPV) or Internal Rate of Return (IRR) can leave decision-makers exposed to risk and blind to opportunity.

Real Options Valuation (ROV) provides a more dynamic framework. It treats project decisions such as delaying development, expanding production, or abandoning a field as strategic options rather than fixed commitments. This approach quantifies the value of flexibility, allowing energy professionals to manage risk more effectively while capturing upside potential.

In the high-stakes world of petroleum economics, where timing and adaptability are everything, ROV isn’t just a sophisticated tool, it’s becoming essential for competitive advantage.

What Is Real Options Valuation in Petroleum Projects?

Real options give oil and gas companies the right but not the obligation to make future investment decisions based on how technical and market uncertainties evolve. These can include:

- Delaying drilling or development

- Expanding production after successful appraisal

- Abandoning uneconomic projects

- Switching technologies or outputs

In petroleum project valuation, real options reflect the managerial flexibility that exists throughout the lifecycle of upstream oil and gas investments. Unlike static DCF models, real options treat projects not as fixed plans but as dynamic opportunities.

Why ROV Matters for Upstream Oil & Gas Projects

Oil and gas projects, especially in exploration and production (E and P), face complex variables:

- Crude oil price volatility

- Reservoir uncertainty

- Capital intensity

- Geopolitical risk

- Fiscal policy shifts

Real Options Valuation provides a way to quantify the value of flexibility in project execution. This is critical in capital allocation, especially for deepwater assets, LNG projects, and unconventional fields.

Key benefits include

- More accurate project valuation under uncertainty

- Improved investment timing and capital efficiency

- Stronger alignment between technical risk and financial strategy

Common Types of Real Options in Oil and Gas Projects

1. Exploration Option

After acquiring a license or seismic data, a company can decide whether to drill. The option to proceed based on better data or prices holds significant value.

2. Development Delay Option

In a high-cost environment or low oil price scenario, the option to defer development until conditions improve preserves capital and enhances long-term value.

3. Expansion Option

Initial infrastructure may be sized for conservative output. If wells perform better than expected, the firm can expand processing capacity.

4. Abandonment Option

ROV models allow operators to quantify the option of exiting projects when marginal costs exceed expected revenues vital for risk management in marginal fields.

Integrating Real Options Valuation into Petroleum Economics

To apply ROV effectively in oil and gas finance:

- Start with the base case NPV or IRR using discounted cash flow (DCF)

- Identify key flexibility points in the project lifecycle

- Model real options using

- Binomial trees (for staged decisions)

- Black-Scholes model (adapted for real assets)

- Monte Carlo simulations (for multidimensional risk)

- Binomial trees (for staged decisions)

- Add the option value to the base NPV for an adjusted project value

This hybrid approach produces a more realistic valuation for energy investment decisions, especially under uncertain oil prices or evolving regulatory frameworks.

Real Options in Today’s Energy Investment Landscape

As the energy industry transitions toward cleaner and more capital-efficient operations, ROV becomes even more valuable. Whether you’re evaluating

- A new upstream field

- A gas-to-power infrastructure

- A refinery upgrade

- A marginal offshore asset

ROV helps decision-makers understand not just if an investment is worthwhile, but when and how to act.

Final Word: Strategic Flexibility Is a Competitive Edge

In a global oil and gas market driven by price shocks, technical surprises, and shifting policies, the ability to adapt is everything. Real Options Valuation is no longer optional, it’s a strategic imperative.

By integrating ROV into petroleum project economics, energy firms unlock smarter ways to allocate capital, time projects, and manage downside risk. This is especially critical for exploration-focused companies, deepwater developers, and NOCs looking to balance risk with value.

At IAA Energy Resources, we support our clients with expert ROV modeling, scenario analysis, and strategic advisory services, transforming uncertainty into structured opportunity.

Need help implementing real options in your energy portfolio?

Contact us at info@iaaenergyresources.com for training, project support, or strategy workshops.

0 responses on "Real Options Valuation in Petroleum Projects: Enhancing Decision-Making in Uncertain Markets"