Investing during recessions can be a prickly task and depending on the type of investor you are recessions can be a blessing in disguise, click here for more on that!

By definition, a country is said to be in recession when it has 2 consecutive quarters of negative Gross Domestic Product (GDP) growth.Before we go forward, GDP is the value of everything that is produced in a country, whether it is produced by locals (indigenous people) or foreigners is of no consequence – it was produced in the country. So if in your household, you, your wife, your brother etc. earn any money from work, sales of crafts or anything else, that is the total household income.

This is much the same as the GDP of a country which comprises Personal Spending which is what we buy for day to day living as individuals (PS), Government spending (G), Business spending (B), Exports (E) and Imports (I). If we were to write this as an equation, we would say:

GDP = PS + G + B + E – I

Therefore if in 6 months, the GDP has decreased at each quarter, the country is said to be in a recession. It is important to note that recessions are not necessarily a bad thing even though they are quite painful (especially when they are caused by inappropriate policies) because it helps us in the following ways:

- It accelerates improvements in business processes.

- It causes us to be less wasteful.

- It helps Governments create / revamp fiscal rules (hopefully, if this is done right).

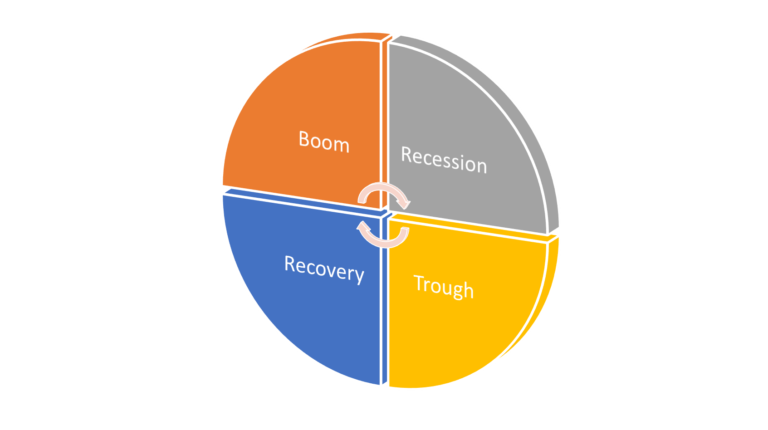

Recessions are a part of the business cycle as shown in the diagram below and no country is immune. The questions are, what does the government do next? Or, what do you do with your investments (capital/ funds) during a recession?

In investment, we see that during recessions, companies report losses (usually) and some businesses essentially die a natural death as they cannot survive the tough times. One key reason is that many people stop buying stuff or reduce their spending habits because they feel they don’t need them. Another reason is that costs (raw material or operating) can significantly go up and the company may not be able to transfer these costs (via pricing) to their customers (due to high competition). That said, we need to ensure that we are poised to benefit when economy picks up by investing in the right stocks. This is where defensive or cyclical stocks come into play. There are aggressive stocks but for the purpose of this discourse, I will just cover the 2 types mentioned earlier.

In investment, we see that during recessions, companies report losses (usually) and some businesses essentially die a natural death as they cannot survive the tough times. One key reason is that many people stop buying stuff or reduce their spending habits because they feel they don’t need them. Another reason is that costs (raw material or operating) can significantly go up and the company may not be able to transfer these costs (via pricing) to their customers (due to high competition). That said, we need to ensure that we are poised to benefit when economy picks up by investing in the right stocks. This is where defensive or cyclical stocks come into play. There are aggressive stocks but for the purpose of this discourse, I will just cover the 2 types mentioned earlier.

First, what are defensive stocks? They are stocks of companies that perform well when the economy or the general stick market is not doing great – like during a recession. Stocks like (NSE:NESTLE) belong to the food and beverages industry (as people must eat) and is very good example of defensive stocks. “Sin industry” stocks like is cigarette or even alcohol manufacturers (NSE:CHAMPION or NSE:GUINNESS) are also good during recessions because well, many smokers will still want to smoke and drinkers will still want to drink – this may be counter-intuitive but it can be more evident during recessions.

Instead of going ahead and buying new stuff, people will rather repair what they have so during recessions, so renovation companies may see a rise in fortune. Finally, because people get sick, must pay taxes and must get rid of their unwanted stuff (like waste) no matter the state of the economy, pharmaceutical and health providers (NSE:GLAXOSMITH, NSE:EVANSMED) and waste disposal companies are usually in demand and are therefore very good stocks to invest in.

Cyclical stocks on the other hand are really sensitive to the business cycle. This means that when the economy is doing well (the boom or recovery phases), these stocks begin to do well because they get profitable so people want their stocks (higher demand for their stocks). Sectors that benefit from this “boom/ Bust” cycle include Construction (NSE:JBERGER, NSE:ROADS), Industry (NSE:AUSTINLAZ, NSE:BERGER), Information Technology (NSE:COURTVILLE) and even Consumer Discretionary goods (NSE:VITAFOAM).

For example, you may notice that construction work picks up when the economy is booming and people want to change their phones, cars etc. as they have more discretionary money to spend in that same situation. Cyclical stocks are quite cool (in my opinion) because it avails me (or investors) the opportunity to invest in stock that I (or they) believe are under-priced due to the economic realities on ground. For instance, I valued a stock (I won’t spill here) sometime ago based on how it performed during a boom and the stock lost over 60% of its value when the economy worsened. Guess what? I bought the stock and when it bounced back I made, well, quite a bit from my investment.

The key thing to note is that in recessions, defensive companies do well as people want their stocks and the reverse is the case (most times) when the economic situation improves as people now want cyclical or aggressive stocks when the economic realities get a bit bright.

So you don’t need to runaway from investing in the stock market because there is a recession as it can actually provide you with very valuable investment opportunities as:

- Many investments that do well during recessions also do well when the economy is in a recovery and

- You may be able to find a bargain during recessions for medium to longer term investors

However, do your research and make sure it meets your personal investment goals or you can discuss with your portfolio manager/ adviser.

0 responses on "Stock Market Sentiments"